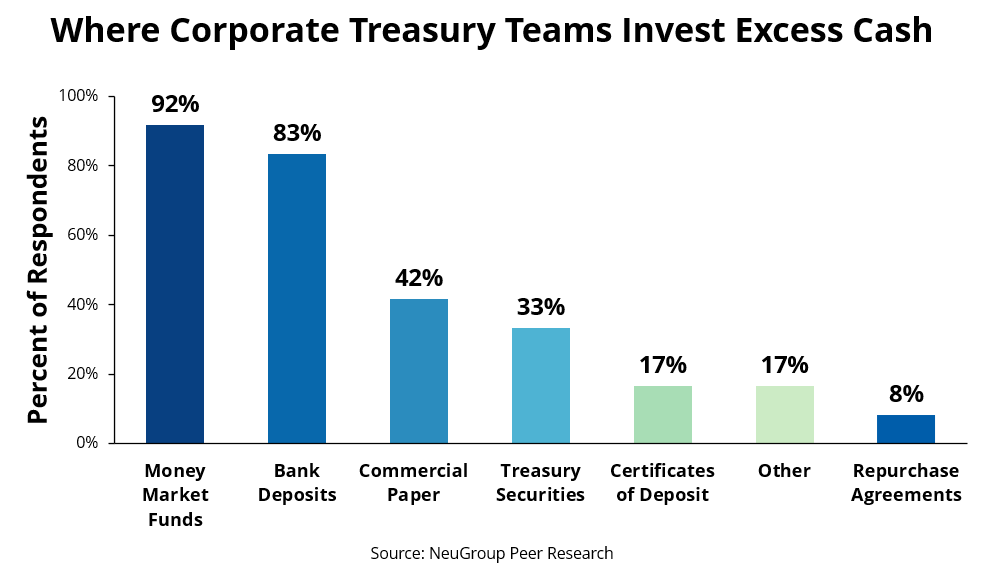

Repos, anyone? The likely answer to that question today from many corporate cash investment managers would be ‘no thanks,’ based on a recent NeuGroup Peer Research survey* of members of NeuGroup for Cash Investments. Some of them discussed the reasons for that reluctance in a focus group sponsored by TreasurySpring, a fintech that operates a global cash investment platform that makes investing in repurchase agreements to reduce risk and generate investment income a less burdensome and thus more appealing option. - NeuGroup’s targeted survey indicates that repos are used by just a small fraction of corporates: Only 8% of respondents said they turn to the repo market to invest excess cash (see chart), compared to 92% choosing money market funds and 83% making use of bank deposits.

- “We’re always focused on preservation of capital first and then liquidity and then yield as a third option,” said one cash investment manager in the focus group, echoing the approach taken by the vast majority of peers.

- Repos are consistent with those priorities, TreasurySpring says, noting they offer corporates an opportunity to receive collateral against cash they lend, while bank deposits are wholly unsecured for amounts over the FDIC limit.

Repos 101. A secured repo is a short-term transaction where one party (e.g., a corporate) lends cash to a borrower (usually a bank or financial institution) in exchange for collateral, typically high-quality securities like U.S. Treasuries. (In this example, the bank is engaging in a repurchase agreement and the corporate in a reverse repurchase agreement.)

- The borrower agrees to repurchase the securities at a later date for a higher price, generating a return for the lender. Repo durations may be overnight or term, meaning between two days and 12 months. The key to the repo’s safety is that the corporate can sell the collateral if the bank is unable to buy back the securities.

- In a tri-party repo, a custodian (think BNY Mellon or JP Morgan) handles collateral selection, settlement and valuation and manages much of the administrative process on behalf of both parties. This is the most common type of repo.

- “Tri-party repo, in which assets are managed and marked-to-market daily by an independent third party, is objectively safer than unsecured bank deposits,” said Kevin Cook, CEO of TreasurySpring, during the focus group.

- One member who sees the appeal of repos to mitigate counterparty risk during, say, a banking crisis put it this way: “If using U.S. Treasuries as collateral, repo is negatively correlated to a risk event, making this an overcollateralized bank account. Repos are more secure.”

Yield appeal. In addition to preservation of capital and risk management benefits, repos at times present the opportunity to earn yields in excess of the federal funds rate. This may occur when markets experience volatility and a lack of liquidity.

Repo impediments. Despite the benefits of safety and diversification, when it comes to direct access to the repo market, the juice is not worth the squeeze for some treasury teams. Half of the survey participants have faced impediments to using repo.

- Among them: technology obstacles (“We’re looking at better integrations, but right now, repo just doesn’t fit cleanly into our systems.”) and management reluctance (“Repo is a different structure that would require more internal buy-in.”). But complex and time intensive onboarding may be the greatest hurdle.

- “The agreements can take six months to a year to set up,” noted one focus group participant. “Getting your bank’s lawyers and your lawyers on the same page is the biggest hurdle.” Another treasurer said, “We use repo, we’ve done it, but it’s just a painful process. We wouldn’t add more and would stick with alternatives if possible.”

- Mr. Cook detailed why tri-party repos take so long to set up. “You’ve got a bunch of things that you need to put in place: a master repurchase agreement or a master securities lending agreement between [the corporate] and the bank. You also need an existing relationship with a tri-party custodian.

- “Then you need to agree on your collateral schedule. Once your documentation is in place, you must agree on what the concentration limits and amounts of over collateralization are on each particular underlying piece of collateral in the basket.”

- He concluded, “Our experience with clients is that there are very few companies that have the desire, wherewithal, bandwidth, connectivity and budget to put all of this in place directly. This was the impetus for the creation of TreasurySpring, to build the infrastructure that allows our clients to access this large, institutional market without the operational overhead.”

Making repos a lighter lift. Despite the challenges of establishing tri-party repo, the underlying sentiment from the focus group was that more treasury teams would add repos to diversify their short-term, fixed-income options if the process were easier. TreasurySpring’s platform—which provides treasurers with access to over 90 different cash investment options across nine currencies, including secured lending in the repo market—does that, according to the company.

Working with major global investment banks including Goldman Sachs, Citibank and Bank of America, TreasurySpring says it enables treasurers to access repo more efficiently through:

- Streamlined onboarding. The solution offers simplified repo market access with a single KYC and onboarding process, removing the need for treasurers to negotiate separate agreements with multiple counterparties, while also handling legal documentation.

- Tech stack integration. The platform offers connectivity with treasury management systems (TMSs) and other treasury tech solutions, ensuring that repo transactions can be executed and reported directly within existing workflows.

- A diverse counterparty network. Through its relationships with GSIBs (global systematically important banks) and other A-rated and higher counterparties across governments, agencies, sovereigns and CP, TreasurySpring offers a one-stop shop for risk-adjusted term products.

One of TreasurySpring’s large corporate clients notes several benefits from using the platform. “It was refreshing to not only gain access to the reverse repo market, but we found we could further diversify our holdings across tenor, credit rating and security.” A director of cash investment who participated in the survey and is considering TreasurySpring stated that the advantages of the platform are that it provides “one agreement and a simplified onboarding process.”

It’s likely that more treasury teams would leverage repos if they could simplify the process and save time. That was the sentiment of at least one member who said, “It is mostly the setup that stops us from investing in repo directly.” As another NeuGroup member succinctly put it, “If there is a safer, secured and return-generating alternative to unsecured deposits, why wouldn’t we consider it?”

*The survey was conducted in February 2025 and completed by 12 NeuGroup members responsible for cash investment. The results provide directional insights, but are not necessarily representative of the full NeuGroup membership.