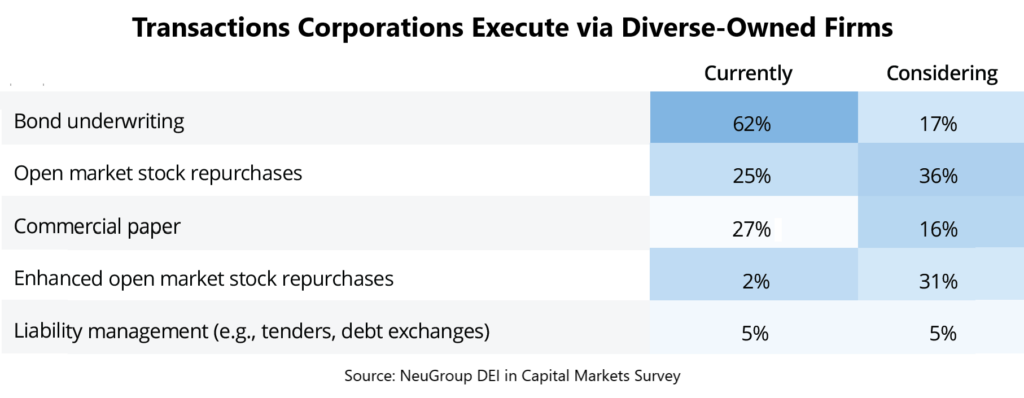

A surge in investment-grade corporate bond deals this year is good news for Wall Street underwriters—including firms whose owners are Black, Hispanic, women and veterans. A new NeuGroup Peer Research report shows that bond underwriting ranks first among the types of capital markets transactions where corporations engage with these diverse-owned firms, with 62% of respondents saying they currently use them in debt deals and another 17% considering it. - That means that bond transactions are a major reason that 66% of the member companies surveyed are already using or plan to work with diverse-owned firms. The firms are also active in working with corporates on open market share repurchases (OMRs) and the issuance of commercial paper (see table).

Advantages and added value. Corporate treasuries are finding both quantitative and qualitative advantages in engaging with diverse-owned firms. Some NeuGroup members say the firms offer better market insights than larger institutions. “In our case, the diverse-owned firms conducted much better analysis ahead of a bond deal,” one survey respondent said. “They looked at our overall debt investor base and dug deeper to find out, for example, what percentage of bonds is held by different types of investors, like insurance firms.”

- Diverse-owned firms also often outperform larger banks in commercial paper issuance and OMRs by providing better execution due to their more narrow focus on certain client transactions, members said. Some treasurers exclusively use diverse-owned firms for these programs.

- “We get better execution than we do with bulge-bracket banks because the smaller institutions pay more attention to our business,” one respondent explained. “We found that they actually outperform the bulge-bracket banks.”

Moving forward. The potential for diverse-owned firms to grow and expand their roles in capital markets activity looks promising, particularly as companies recognize the areas in which the firms can bring value. Treasury leaders from some major companies have been vocal advocates for providing more meaningful opportunities and fee income to diverse-owned firms, aligning these efforts with broader corporate values and goals. - In addition to riding the recent wave of increased debt issuance, the firms’ strength in share buybacks also positions them well for 2024, when S&P 500 companies are expected to spend at least $924 billion on buybacks, up 16% from 2023, according to S&P Dow Jones Indices.

- And the NeuGroup survey shows that almost a third of respondents are considering the firms for so-called enhanced open market repurchase (eOMR) programs. That includes eOMRs offered by Matthews South, which give a corporate the ability to use any broker it chooses, including some diverse-owned firms.

- Jack Yue, treasurer of KLA, told NeuGroup Insights, “We work with more than 10 banks; some are more traditional lending banks that partner with D&I firms. A lot of those banks don’t have the capability to offer structured repurchase, but with this approach, I can share business and wallet.”