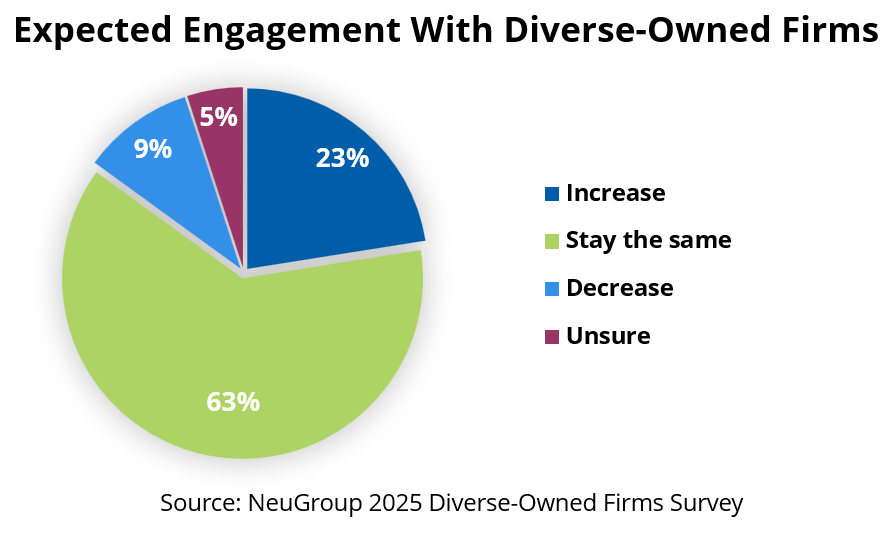

A new survey conducted by NeuGroup Peer Research with Sustainable Fitch shows that most treasury teams remain committed to working with diverse-owned firms in capital markets transactions—with diversifying their investor bases the main reason cited. Their commitment is notable given the shifting discourse around diversity and scrutiny from relationship banks about wallet allocation. - Among the 67% of survey respondents who currently do or plan to do business with diverse-owned firms, 86% expect their level of engagement to stay the same or increase over the next 12–24 months (see chart below). Several treasurers said they have no intention of reversing course, with one participant stating, “We made it clear this is still a priority for us.”

- Some members said their relationship banks are beginning to ask more questions about how fees are distributed, though the actual impact has been limited so far.

- Click here for the full survey results featuring analysis by head of research Joseph Bertran, who explores how treasurers are deepening relationships with diverse-owned firms, the benefits they see from inclusion and the practices shaping allocations in 2025.

Commitment is visible in actions as well as intentions. The survey data shows that allocations to diverse-owned firms are not only holding steady but, in some cases, broadening. Treasurers described taking steps to ensure that engagement remains meaningful rather than symbolic.

- Several companies reported working with diverse-owned firms for multiple years, building trust and familiarity that makes them confident about continued participation.

- One member said he is deliberately narrowing the company’s number of diverse-owned partners to concentrate wallet share, ensuring that selected firms receive revenue streams large enough to matter.

- Treasury leaders highlighted the value of diverse-owned firms’ unique market insights, responsiveness and a client-first approach, with one noting, “If I get 100 emails from banks with their market insight every day, the only one I read is from a diverse-owned firm.”

Relationship banks raise questions, creating some restraints. In a recent NeuGroup virtual session discussing the survey results, some members said their relationship banks have begun asking more questions about how fees are allocated when smaller firms are included.

- While a small number of members in the session said a few lower-tier banks have dropped out of their companies’ revolvers, they stressed that the overall impact has been limited. Even so, the scrutiny has left some feeling constrained and in a few cases has hardened resistance among member companies to expanding allocations to lower-tier banks.

- One treasurer said he now feels “capped” on how much treasury can allocate to smaller players without drawing pushback from relationship banks, but emphasized that the pressure has not translated into reduced access to capital.

- Others, who did lose smaller banks from their groups because the firms felt they weren’t getting enough back, said that the dollars at stake were modest and did not materially affect their access to capital.

- But most members in the session described these pressures as manageable and said they remain committed to sustaining and, in some cases, deepening their partnerships with diverse-owned firms.