In the spirit of the nation’s commemoration of Veterans Day this week, we wanted to spotlight recent NeuGroup research and reporting underscoring that veteran-owned banks and brokerage firms offer value to treasury capital markets teams that extends beyond diversity goals or investor diversification objectives and includes unique perspectives on geopolitics. Wars in Europe and the Middle East as well as global tensions over trade have made that value even more apparent. - Informed insights on world affairs provided by veteran-owned firms are consumed by a broad swath of corporates: Data obtained in producing the 2025 report Evolving the Capital Markets Supplier Mix with Diverse-Owned Firms, shows that 75% of all survey respondents have relationships or have done business with veteran-owned financial institutions.

Strategic insight and strong execution. Treasurers say the strong level of engagement in part reflects that military experience as well as knowledge of foreign policy, finance and economics allow the firms to provide unique insights and analysis. “I noticed some of the military or veteran-owned banks bring that insight and have people on deck who can speak to what’s happening, and how that’s driving the economy,” one member said.

- “The work that they bring in having geopolitical feedback is often not on the forefront for a lot of larger banks,” he added. “By going directly to these firms, we’re getting direct expertise from four- or five-star generals and lieutenants who currently advise folks in the Department of Defense.”

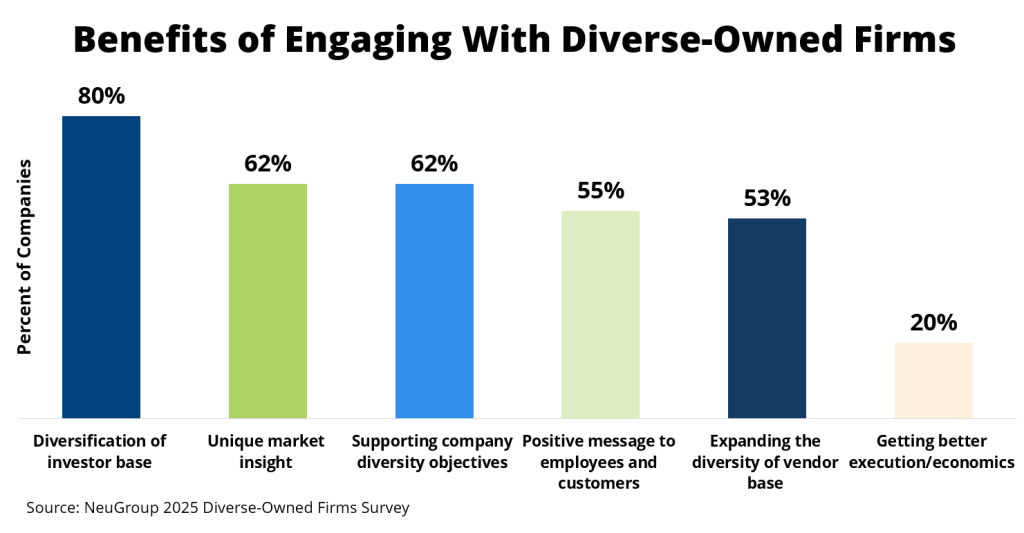

Bigger picture. More broadly, unique market insights are increasingly recognized as a key benefit of engaging with diverse-owned banks and brokerages overall: 62% of respondents cited these insights as a reason they work with the firms (see chart above), up from 39% in 2024. The same percentage (62%) mentioned support of company diversity objectives as a benefit.

- The 2025 survey shows that the top benefit of engaging with diverse-owned firms is diversification of the investor base, cited by 80% of respondents. Treasurers like opening access to new pools of capital and reducing reliance on the largest institutional investors.

- “The investor set that they bring—being more tier two, tier three—they’re going to those niche areas and finding smaller investors that are diverse themselves,” one member said. “It’s a full-circle experience.”