Member question 1: “Going out to one year for EUR, what size tranches are you trading for EUR forwards? Could I trade $10 million-$20 million? $20 million-$30 million?

Peer answer 1: “The one-year EUR forward is pretty liquid, but to keep the spread narrow, we typically keep our size under USD 30 million equivalent per trade.”

Peer answer 2: “Liquidity in one-year EUR forwards is very good. We have traded over $50 million equivalent.”

Peer answer 3: “I would be comfortable trading up to ~$100 million using a straight forward. Above that, we would normally go with an algo and then a swap where the algo can go about as high as you need it and for the swaps we find $200 million-$250 million readily tradeable.”

Peer answer 4: “We have some EUR hedges going out a year in that $20 million-$30 million range for our cash flow program.”

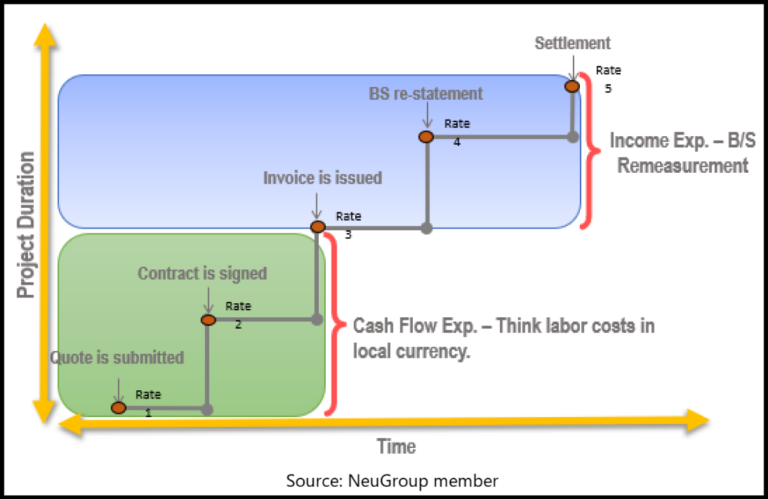

Member question 2: “Do you hedge depreciation as part of operating expense exposures through your cash flow hedging program?”

Peer answer 1: “We only hedge cash items (which makes sense to me). I’d be curious to hear if someone does something different and why.

- “I would imagine you should exclude it as the economic event has already taken place and the underlying activity is hitting your P&L at the historical vs. current rate over the item’s useful life. Contrasted against revenue/cost/etc., where you are hedging a future forecasted transaction that hasn’t occurred but is planned.

- “Below is a diagram I used to frame the problem.”

Peer answer 2: “We actually do include depreciation in the calculation of earnings that we hedge. The rationale is that it’s a crude placeholder for capex. However, we are long everywhere, so including depreciation decreases how long we think we are. Including depreciation in our earnings assessment is certainly debatable.”

Peer answer 3: “Depreciation is not an FX exposure.”