Articles

March 20, 2025

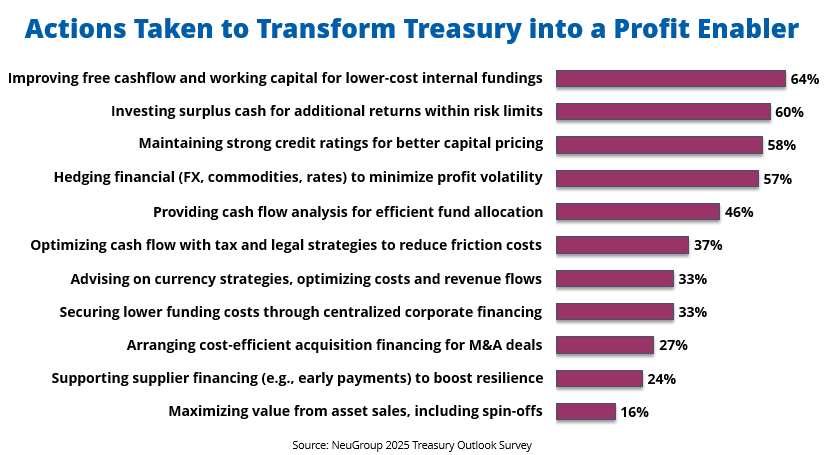

Rocketing Revenue: Treasury Transforms Into a Profit Enabler

# Cash and Working Capital

# Risk Management

A Treasury Outlook Survey highlights how treasury leaders are taking steps to add value to the business, cutting costs and boosting revenue.

Popular

Dive in