When Pfizer agreed last week to a deal with the Trump administration that will lower U.S. Medicaid drug prices in exchange for a three-year exemption from tariffs, it highlighted the trade-off some life sciences companies now face. The deal ties pricing directly to tariff relief—two political pressures that featured prominently in discussions at the recent second-half meeting of NeuGroup for Life Sciences Treasurers sponsored by Fitch Ratings. - The discussion followed the administration’s threat of new 100% tariffs on branded pharmaceutical imports—duties now on hold as the White House negotiates pricing agreements with major drugmakers.

- Some members said “area for area” localized production—manufacturing goods where companies sell them—and selective exemptions will help limit tariff damage. Corporations are also investing in U.S. manufacturing to get ahead of policy. In September, Eli Lilly joined Johnson & Johnson in announcing domestic expansion projects, which align with the push to localize production and can also cut FX hedging costs.

- Members said the administration’s “most favored nation” (MFN) pricing policy—requiring U.S. prices to match the lowest paid in peer countries—poses the deeper challenge. For now, the policy is being applied to Medicaid, but members said that if it is extended to Medicare or commercial markets, it could reshape profitability and cash flow across the sector.

- Fitch Ratings’ head of healthcare and pharma, Britton Costa, said while the outlook for the sector has turned more cautious, “a deteriorating sector outlook doesn’t necessarily lead to negative outlooks for all companies.” He said corporates with strong fundamentals, relatively less exposure to tariffs and financial “headroom” that respond strategically to policy changes have more positive prospects.

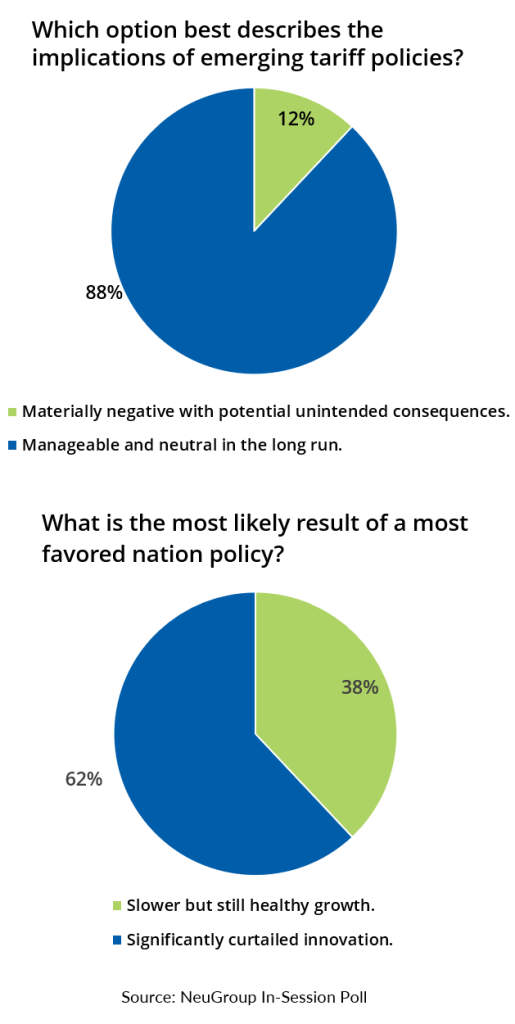

How members are reading risk. In two in-session polls (see charts below), members said they see tariffs as a near-term operational nuisance—but MFN as a structural challenge that could affect the ability to finance research.

A mixed picture. The session underscored that some companies were already in a stronger position to mitigate the effect of tariffs than others. “We do mostly manufacture for regions—Europe for Europe, Asia for Asia, U.S. for U.S. That’s saved us this year,” one treasurer said.

- By contrast, a different member said, “Our main product’s ingredient comes from China. A second source has taken years, and we’re not even close, so we’re stuck with the rules as intended.” Another said, “Building a facility takes five to ten years. Who knows what the policy will be then? It’s hard to react.”

- To buffer volatility, treasurers are tightening working capital cycles by relying on procurement teams to optimize invoice timing, and renegotiating terms with suppliers as well as customers. Members described working capital programs as their first line of defense while policies remain in flux.

Drug costs and the courts. On the pricing front, MFN would require companies to offer reimbursements to match the lowest prices in other developed global markets—compressing the U.S. cash generation that funds global R&D and debt service. Some observers expect legal challenges to MFN.

- Indeed, many members believe the next move rests with the courts. “I don’t think ‘most favored nation’ will stand as written. They’ll have to go after it another way,” one said. For now, some companies are modeling scenarios program-by-program (if the policy impacts Medicaid first, then Medicare) and stress-testing the potential business impact of each.