Despite early hope for a more M&A-friendly approach from the Trump administration, the landscape for acquisition has grown more uncertain in recent weeks as concerns around tariffs, regulatory shifts and the potential impact of new antitrust policies have increased. But treasury teams at life sciences companies say they are still preparing to pursue M&A. The motivation? Looming revenue shortfalls as patent protections expire and royalty streams dry up. - A growing number of top-selling prescription drugs will lose patent protection over the next several years—allowing lower-cost competitors to enter the market and erode revenue—pushing companies to find new sources of income through acquisitions.

- “We’re going to lose royalties in the next few years,” one member said. “And we’re going to need to replace that.”

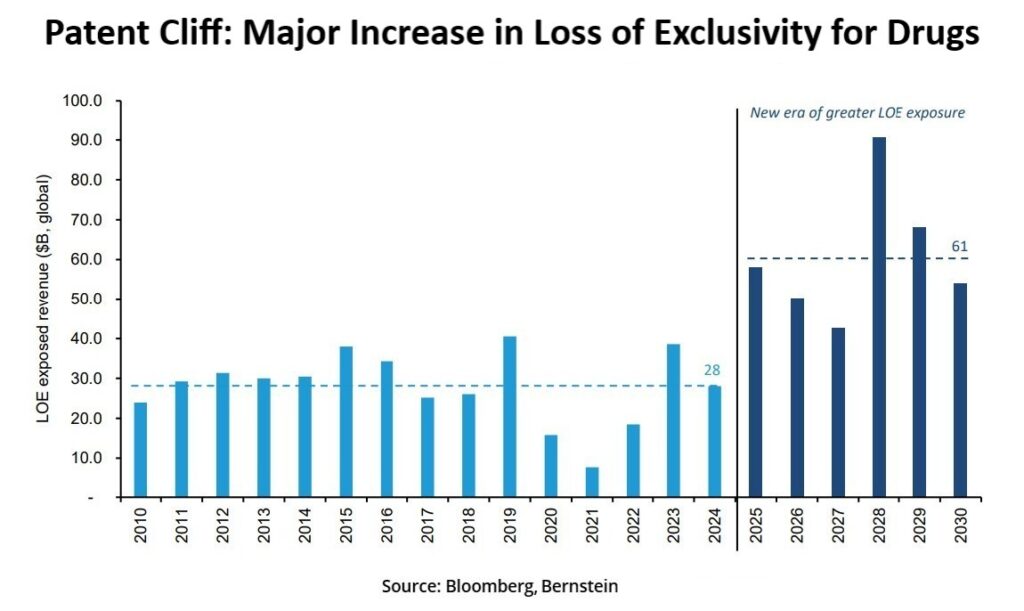

A coming wave of “LOE” risk. The chart above, presented in the session by Bernstein Research senior analyst for US biotech Will Pickering, shows a sharp rise in the annual revenue at risk as major drug patents expire—an industry pattern known as the loss of exclusivity, or LOE. The dotted lines, as added by Bernstein pharma analyst Courtney Breen, show the average LOE for two periods, with 2025-2030 expected to more than double the LOE of the previous 15 years.

- “What the chart on this slide depicts is the peak sales of drugs across the industry that are rolling off due to patent cliffs each year,” Dr. Pickering said. “As you can see, it’s a lot higher over the next five years, as opposed to the past.”

- “It may take longer for deals to materialize, given recent news, but M&A is going to have to get done at some point, the chart clearly shows that,” he said. “It’s just a question of when does it happen: is it going to be later this year, or the first half of next year? Maybe some deals have been pushed into 2026, but that’s the bottom line.”

Preparing to pounce. Multiple members in the meeting said they expect business development spending to pick back up, particularly in M&A deals. A number of treasurers have excess cash on their balance sheet and said they could see an acquisition making sense.

- “We have lots of cash, and though there’s no M&A deal recently announced, I can’t imagine there are no deals this year,” one member said.

- Another member said his company is seriously evaluating the funding strategy for their next M&A deal as they stare down critical royalties expiring soon—but are cautious of how rating agencies may react to deals in the current market.

Creativity amid capital constraints. Grappling with cash flow constraints and the need to secure future revenue is prompting more innovative approaches to deal structure, according to a Societe Generale presenter. “Where there’s uncertainty, you’re going to see more creativity,” he said at the meeting.

- “You’re not going to be able to raise capital at the same rates, so there’s going to be some hard thinking as to what’s the best way to create value, and to preserve value.”

- He added that while recent years saw healthcare lose favor among investors, “there will be reversion to the mean,” driven in part by the long-term M&A pressure created by the patent cliff. “I believe the worst is behind us.”