Mega-cap treasurers are keeping teams lean, with a new NeuGroup Peer Research survey showing only a few areas of growth, specifically technology and cash forecasting, offset by decreases where technology is reducing the need for as many people.

- Rapid advances in automation, machine learning and AI are creating demand for tech and forecasting expertise. Treasury teams throughout the NeuGroup Network are hoping to shift some headcount from staff performing manual tasks to dedicated tech experts and data scientists, for example, rather than competing for corporate IT resources.

- More broadly, the survey found an average overall treasury team size of 52 people, with a median of 37. All participating companies had revenue above $5 billion, with 85% above $20 billion.

- At a recent session of NeuGroup for Mega-Cap Treasurers, where head of research Joseph Bertran shared the results, a live poll showed most treasurers had four to five direct reports (excluding admin staff) and three to five layers of seniority beneath them, with four the most common.

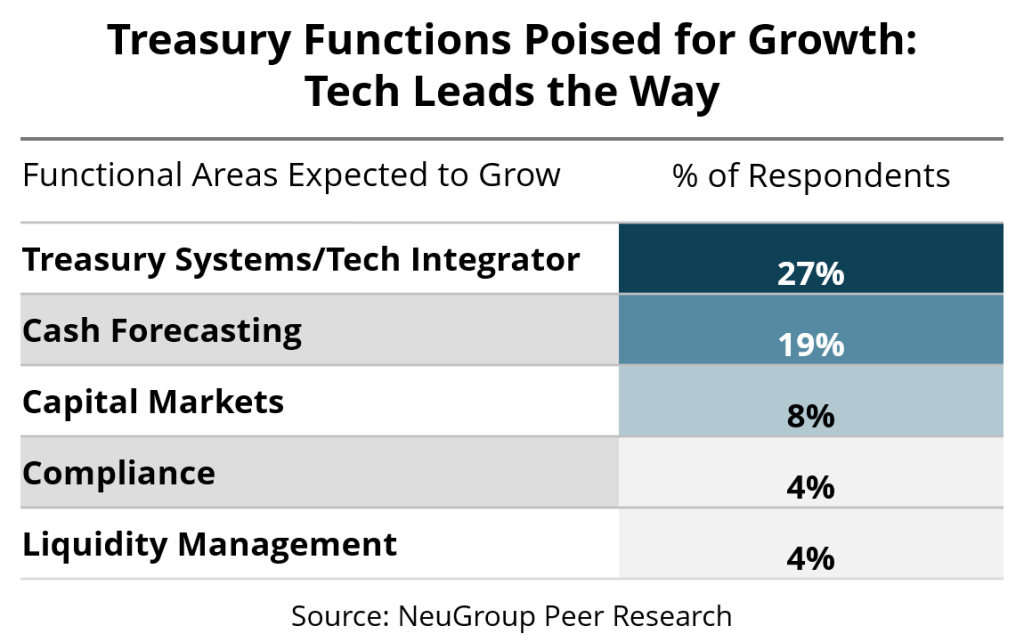

Asked how staffing across functions within treasury is likely to change in the near term, most members signaled limited plans for expansion (see chart for the five areas most likely to grow). The full survey results show treasurers expect more functions to decrease than increase, reflecting efficiency gains from automation and new systems.

- Technology and systems integration drew the strongest gains, with more than a quarter (27%) of companies planning to add staff. One member described the impact of bringing in outside expertise: “We continue to run into issues with what do we do with AI. We said, ‘We’re going to have to go outside of treasury expertise in our hiring process,’ and hired a talented AI individual, who has been game-changing for the entire treasury organization.”

- Cash forecasting also showed increases, reflecting pressure for accuracy and automation. Several members noted that the rise of AI and analytics tools has made enhancing cash forecasting processes a top treasury priority.

- Capital markets, compliance and liquidity management saw smaller but notable upticks, reflecting targeted investment in areas where expertise and precision are increasingly critical.

Reshaping, not resizing. “The picture tells a story,” Mr. Bertran said. “Teams aren’t aiming to get larger, but they are reshuffling where resources go. Technology is the standout, and that’s a consistent theme we keep hearing from members.”

- One member put it more bluntly: “Nobody wants more treasury; they want the outcome.” But members noted that delivering those outcomes often requires more investment in systems, skills and technology. Benchmarking like this survey, one member said, can help provide the evidence to make the case for resources and explain why their teams look the way they do.

- That pressure to do more with less is familiar to treasurers, who must often defend headcount in the face of budget constraints and scrutiny from leadership. “We’re facing tremendous challenges to cover zero cost increases, and also give raises,” one member said, adding that flexibility in shifting resources has become essential.